Financial, identity and privacy protection tools to help you manager your financial health.

Basic Features included for FREE

- A Vantage Score 3.0 provided by Experian

- Dark Web Monitoring

- View exposed private information

- View online Subscriptions

Premium Subscription is $8.99/month. In addition to the basic features you also receive a number of additional options.

- Experian Credit Monitoring and Alerts

- Equifax Credit Monitoring and Alerts

- TransUnion Credit Monitoring and Alerts

- Social Security Number Monitoring

- Change of Address Monitoring

- Identity Theft Insurance and Restoration

- Removal of Personal Information from Brokage Sites

- Ongoing Web Monitoring for Newly-Exposed Private Information

- Cancel Online Subscriptions

Contacting Credit Bureaus for Disputes or Discrepancies

Equifax: Visit <> or call (888) 766-0008

Vantage vs. FICO Scores

My Financial Health - (Array) uses the Vantage Method for your Credit Scores.

How is my credit score calculated?

In addition to calculating credit scores themselves, the three major credit bureaus, Equifax, Experian, and TransUnion, provide detailed information about a consumer’s credit activity to other companies that calculate a credit score.

The two major companies providing credit scores are FICO® and VantageScore. Each uses a proprietary method to calculate their score.

FICO® Score

FICO considers the following when calculating your score (source):

Payment history (35%)

- Do you make your payments on time?

Amounts owed (30%)

- Do you owe too much to too many lenders?

Length of credit history (15%)

- Does your record show that you can maintain your commitment over a period of time?

New credit (10%)

- Have you opened multiple new accounts in a short period of time?

Credit mix (10%)

- Do you have a variety of account types, such as credit cards, installment loans, or a mortgage?

VantageScore 3.0 considers the following when calculating your score : ( Source)

- Payment history (40%)

- Utilization ( 20%)

- Balances (11%)

- Depth of Credit (21%)

- Recent Credit (5%) Available Credit (3%)

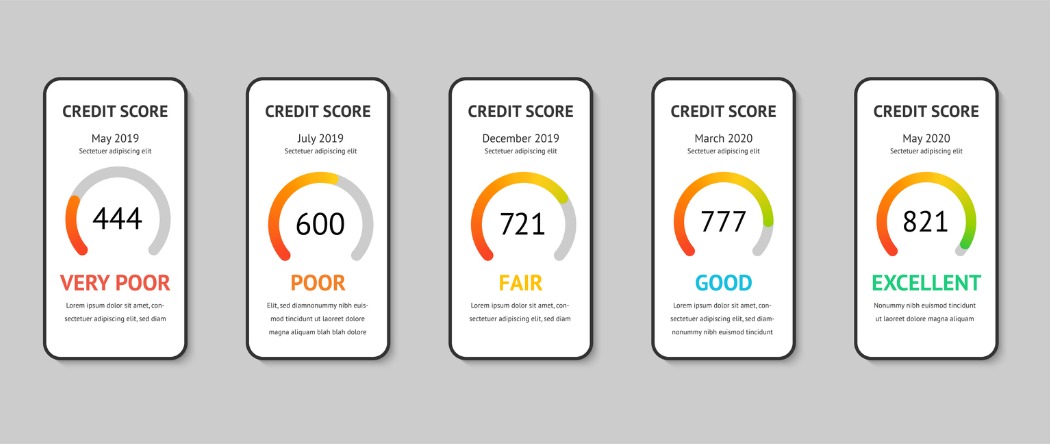

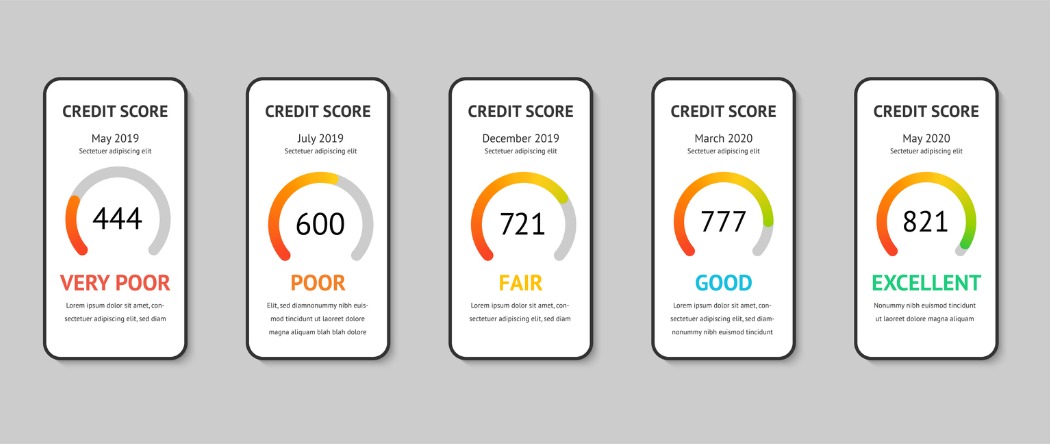

300 – 499: Very poor

500 – 600: Poor

601 – 660: Fair

661 – 780: Good

781 – 850: Excellent

300 – 600: Subprime

601 – 660: Near prime

651 – 780: Prime

781 – 850: Superprime